It sounds too good to be true, doesn’t it? The idea of achieving free travel across the U.S. and potentially beyond can easily make anyone skeptical. But having spent years exploring the world of travel rewards, I can genuinely say it’s not only possible but surprisingly achievable for many. Over the past five years alone, my family has enjoyed over 160 hotel nights and close to 100 flights within the United States – all without paying a dime in cash for transportation or accommodation. This isn’t some elaborate scheme; it’s a strategic approach using credit card points effectively, a method that has profoundly changed how we experience travel and explore new places.

My Personal Journey Towards Free Travel

My first real taste of desired travel came shortly after Linda and I married. Our humble beginnings meant practical needs, like a new bed, took priority over a lavish honeymoon. Thankfully, a kind couple from our church offered us their beach house for free, providing our first truly memorable trip together. It was a simple honeymoon, but it ignited a passion for exploring alongside the person I loved.

Growing up, family vacations were part of life, but experiencing travel as an adult, making my own choices, felt completely different. I started dreaming of visiting various cities across the U.S. Then, the harsh reality of travel costs hit me. Flights, even domestic ones, were shockingly expensive, and even budget hotels demanded a significant chunk of cash. With entry-level jobs and a substantial debt to tackle, travel seemed like an unreachable luxury for the foreseeable future. It felt like exploring dreamed-of places to vacation in michigan or any other state was just a distant fantasy.

Years passed, and we worked diligently towards our financial goals. It was during this period that I stumbled upon the “secret” that has since allowed us to travel the U.S. frequently without the burden of traditional travel costs. This method, centered around travel rewards points, transformed what seemed financially impossible into our everyday reality.

The Core Strategy: Unlocking Travel Rewards

After extensive research and hands-on experience with various credit cards and rewards programs, I discovered that not all points are created equal. The value you get from loyalty points can vary dramatically between programs. Some might offer a large sign-up bonus, but those points are worth very little when redeemed for flights or hotels.

For example, a 50,000-point bonus from one program might only cover a single flight or hotel night. In stark contrast, I found a program where 50,000 points could cover 10 nights in a decent hotel – a tangible benefit worth over $1000, simply from utilizing card rewards. This stark difference highlights the importance of choosing the right rewards currency. One high-yielding program can be five to ten times more valuable than another. Simply earning points isn’t enough; you need points that offer exceptional redemption value for achieving genuine free travel.

How You Can Start Earning Points for Free Travel

The primary ways to accumulate significant points quickly are straightforward:

- Sign-Up Bonuses: Many travel rewards credit cards offer generous point bonuses when you open a new account and meet a specific spending requirement within the first few months. These bonuses can range from 30,000 to 80,000 points or even more and are often the fastest way to earn enough for a trip.

- Everyday Spending: Using your chosen card for daily expenses (groceries, bills, gas, etc.) earns points on every dollar spent. The best cards offer at least one point per dollar spent, often more for specific categories like dining or travel.

While there are other niche methods to earn points, focusing on these two core strategies provides the most significant return for most people aiming for free travel.

Identifying the Most Valuable Programs

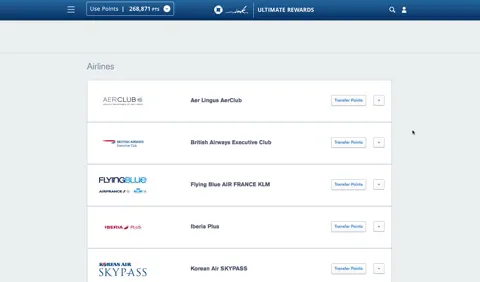

Based on my experience over the years, Chase Ultimate Rewards has consistently offered the most versatile and valuable points for U.S. domestic travel. Their points can be redeemed directly for travel through their portal, but the real power lies in transferring them to select airline and hotel partners.

For maximizing value, I’ve found that transferring Chase points to Southwest Airlines for flights and World of Hyatt for hotel stays yields the best results about 90% of the time. These partners have strong domestic networks and incredibly favorable redemption rates compared to many other programs.

Both Southwest and Hyatt are reliable companies with excellent customer service, and their rewards programs are genuinely generous.

reward point options

reward point options

What Free Travel Looks Like in Practice

For us, this strategy means putting as much of our regular spending as possible onto our primary Chase credit cards. Between personal and business expenses, we typically spend upwards of $5,000 per month. This spending alone generates at least 5,000 points monthly, enough for a free night at many Hyatt hotels or a short Southwest flight.

Consider the impact of sign-up bonuses on top of this. When I first started, I opened several cards strategically to earn initial bonuses. A common 50,000-point sign-up bonus from a card like the Chase Sapphire Preferred can easily translate into a week or more of free nights at Hyatt properties. Many hotels that cost around $130/night can be booked for just 5,000 points. A 50,000-point bonus could cover 10 nights, saving you $1,300 in hotel costs!

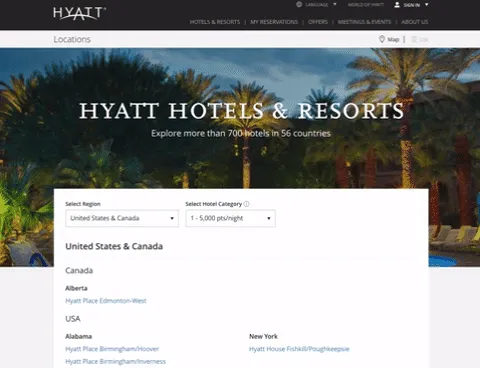

While luxurious Hyatt properties can cost upwards of 30,000 points per night, World of Hyatt has a Category 1 tier where nights cost only 5,000 points. At the time of writing, there were well over a hundred Hyatt hotels in the U.S. and Canada falling into this category, offering incredible value for your points.

hyatt-hotel-options

hyatt-hotel-options

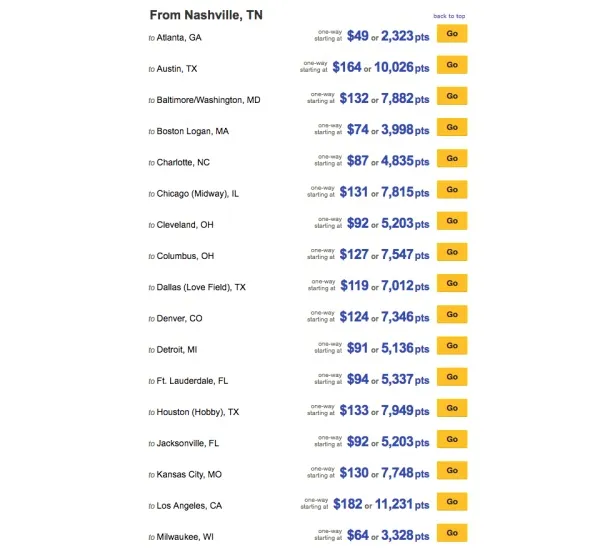

Southwest Airlines also offers exceptional value. A 50,000-point bonus can cover multiple round-trip flights depending on the route and price.

The Southwest Advantage for Free Travel

My appreciation for Southwest and the points I earned with them grew significantly during a spontaneous trip to adopt our daughter. We had to travel cross-state on extremely short notice. While I could use points for my family, I needed my mom to join us quickly to help with our older child. Unfortunately, Southwest didn’t fly to the small town where our daughter was born. Booking a last-minute flight on another airline cost $500 cash – a stark reminder of how much we relied on points and how valuable they were. While I would pay that $500 again instantly for my mom’s help, it underscored the immense savings provided by points.

southwest-flights-nashville

southwest-flights-nashville

Southwest also has incredibly customer-friendly policies that enhance the value of point redemptions:

- You can cancel flights for any reason and get all your points fully refunded.

- If the points price of a flight decreases after you book, you can contact them, and they will refund the difference to your account.

- Perhaps best of all, two checked bags fly free for every passenger!

Addressing the “Catch”

It’s reasonable to wonder if there’s a hidden catch. The truth is there aren’t nefarious tricks, but there are a few things to be aware of:

- Minimum Spend Requirements: Cards offering large sign-up bonuses typically require you to spend a certain amount (e.g., $3,000) within the first few months (e.g., 3 months) to earn the bonus. This ensures you actively use the card.

- Annual Fees: Some premium travel cards have annual fees, often around $95. Many waive the fee for the first year. You need to evaluate if the benefits you receive (including the value of earned points) outweigh the fee. If you’re no longer actively using a card, consider canceling it before the annual fee hits.

How Credit Card Companies Benefit

So, if you’re getting all this “free travel,” how do the credit card companies make money? Their primary revenue streams come from:

- Interest Charges: This is their biggest earner, but only if cardholders carry a balance and pay interest.

- Merchant Fees: Businesses pay a small percentage of each transaction fee to the credit card networks and banks.

This is crucial: You do NOT need to pay interest to benefit from travel rewards. By paying your balance in full each month, the credit card company still makes money from the merchant fees, and you get to reap the rewards. In my over five years of using this strategy, I have never paid a single dollar in credit card interest. This is the most important rule for making this strategy work for free travel.

The Life-Changing Impact of Free Travel

Beyond the sheer numbers (161 hotel nights, 97 flights, potentially saving $45k-$60k), the ability to achieve free travel has had a profound impact on our lives.

- Flexibility: During the interstate adoption processes for both our children, we were required to remain in the state of birth for 7-14 days. Having earned points allowed us to book Hyatt hotel stays for the entire duration without worrying about the significant accommodation cost during such an already stressful and expensive time.

- Seeing Family More Often: Moving away meant family is now spread across the country. Our points balance means we rarely have to factor in the cost of flights when deciding to visit loved ones, making it much easier to stay connected.

- Exploring More: This ability to achieve free travel has fundamentally changed how we explore. While our focus initially was within the U.S., unlocking these points opened up countless possibilities, from spontaneous trips to visit family to exploring beautiful vacation spots like potential michigan vacation spots. We’ve visited so many places to vacation in michigan and elsewhere…

- Giving Back: An unexpected joy has been the ability to occasionally use our accumulated points to help friends or family with their travel needs.

Essential Advice Before You Start

This strategy works wonders, but it’s absolutely critical that you use credit cards responsibly. If you are someone who struggles with debt or is unable to pay off your credit card balance in full every single month, this strategy is NOT for you. The interest charges you would incur would quickly outweigh the value of any points earned.

If you anticipate even a single month where you might not pay off the full balance, I strongly advise against pursuing this path with travel rewards cards. Financial discipline is paramount.

How to Get Started with Free Travel

Assuming you are committed to responsible credit card use, here are the basic steps to begin your journey towards free travel:

My favorite tool for free travel

My favorite tool for free travel

- Open One Strategic Card: Most travel experts, myself included, recommend starting with the Chase Sapphire Preferred® Card due to its versatile points and strong transfer partners. It’s widely regarded as one of the best entry points into the travel rewards world.

- Meet the Minimum Spend: Use this card for your regular, budgeted expenses to meet the initial spending requirement and earn the valuable sign-up bonus. Crucially, only spend what you can afford to pay back immediately.

- Start Redeeming: Once the bonus points hit your account (usually within a month or two after meeting the spend), you are ready to book! You can transfer points to partners like Southwest or Hyatt, or explore other redemption options like booking directly through the Chase portal.

Even financial experts like Jean Chatzky, the Today Show Financial Editor, have echoed the sentiment about the value of cards like the Chase Sapphire Preferred® Card and strategic credit card rewards use for travel.

FAQ

Is “free travel” really free, or are there hidden costs?

While the flights and hotel stays booked with points are free of the standard cash cost, you are still responsible for taxes and fees (these are usually minimal, especially on U.S. domestic flights booked with points). You also need to consider the cost of the annual fee for certain cards (if not waived the first year) and the discipline required to meet minimum spending without overspending your budget. So, it’s “free” in terms of the major expense (airfare/hotel), but requires careful management and minor associated costs.

Does opening credit cards hurt my credit score?

Opening new credit accounts can temporarily lower your score by a few points, but the impact is usually minor and short-lived, especially if you maintain a good payment history, keep credit utilization low, and don’t open many cards at once. Over time, responsible use can actually improve your score by increasing your available credit and demonstrating a good credit history.

What if I can’t meet the minimum spending requirement?

If you are unable to meet the minimum spend requirement through your normal, budgeted expenses, it’s generally not worth opening the card solely for the bonus. Overspending just to earn points means the cost of the extra spending outweighs the value of the rewards. Focus on responsible spending first.

This strategy requires discipline, research, and careful execution, but the rewards—the ability to experience free travel and explore the world around you—are immeasurably valuable.